Money kit

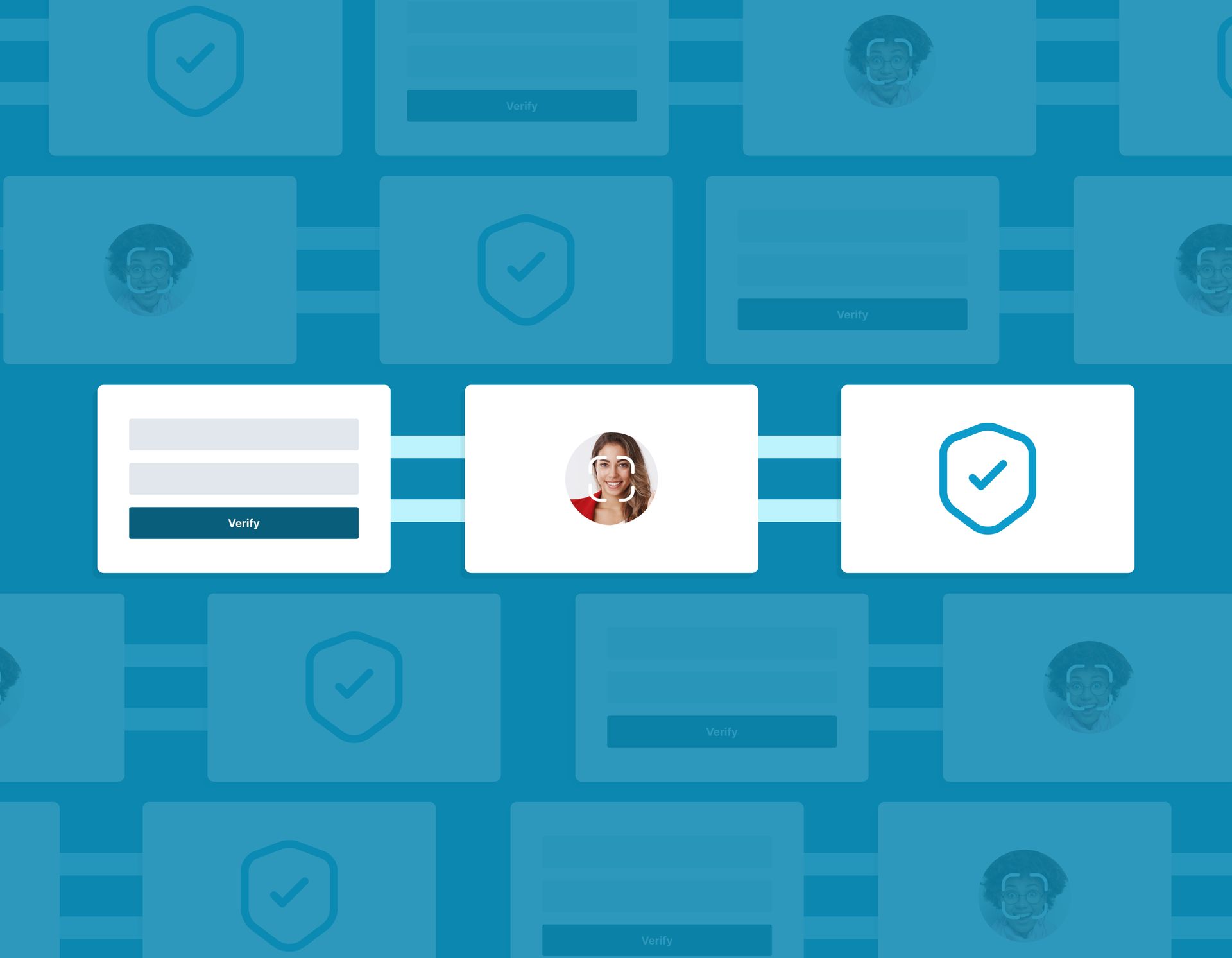

Solve consumer money needs with modern money stack

Mobile Wallets Card Issuing P2P Payments

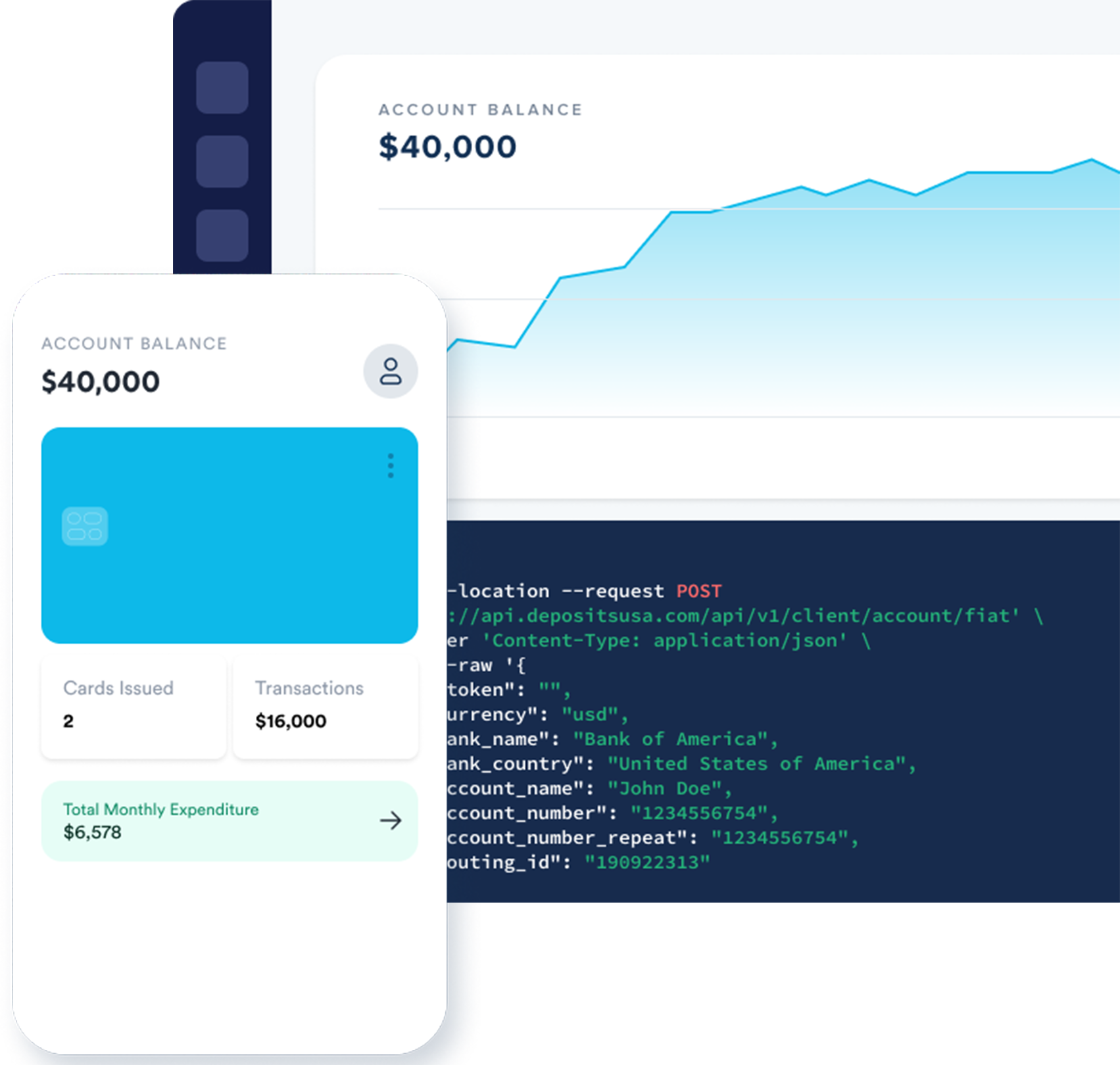

Card Programs

Easily create and manage virtual and physical cards. Everything you need to create a card program that suites your model

Advanced features

Full-featured digital wallet with support for P2P Transfers, Bill & Merchant Payments, Push to Debit, and Multi-currency wallet use cases.

Payment Acceptance

Build and scale a flexible card program that delivers reliable money experiences for your users - however they choose to pay

HOW IT WORKS

The platform money experience

is built-on

Build and launch international remittance, multi-currency wallets, PFM app, or bill pay. The Money kit from Deposits is the toolkit to launch innovative fintech products.