Banking kit

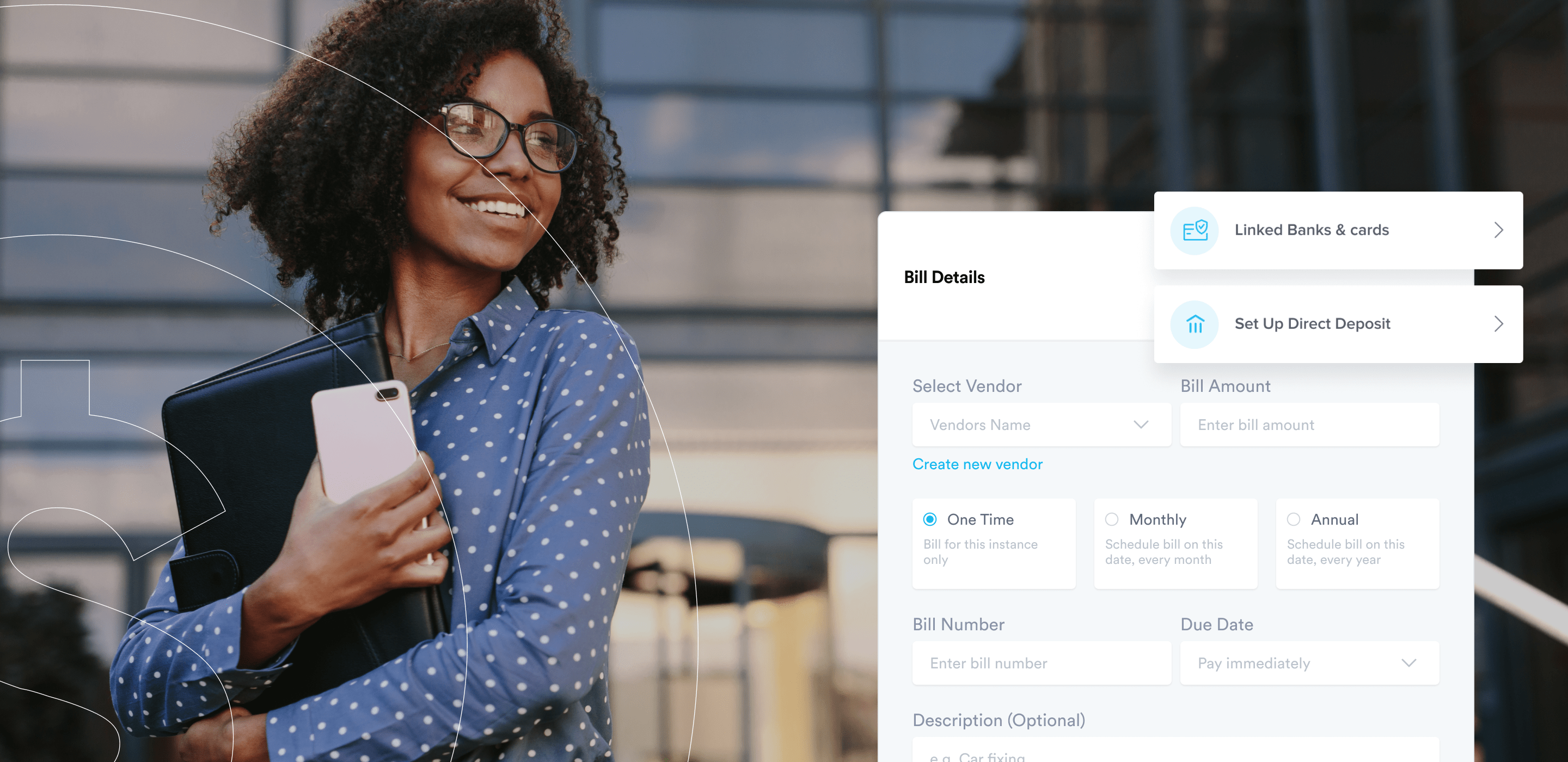

Plug and play digital banking platform & widgets

SMB Banking suite Multi-currency Payouts Corporate cards

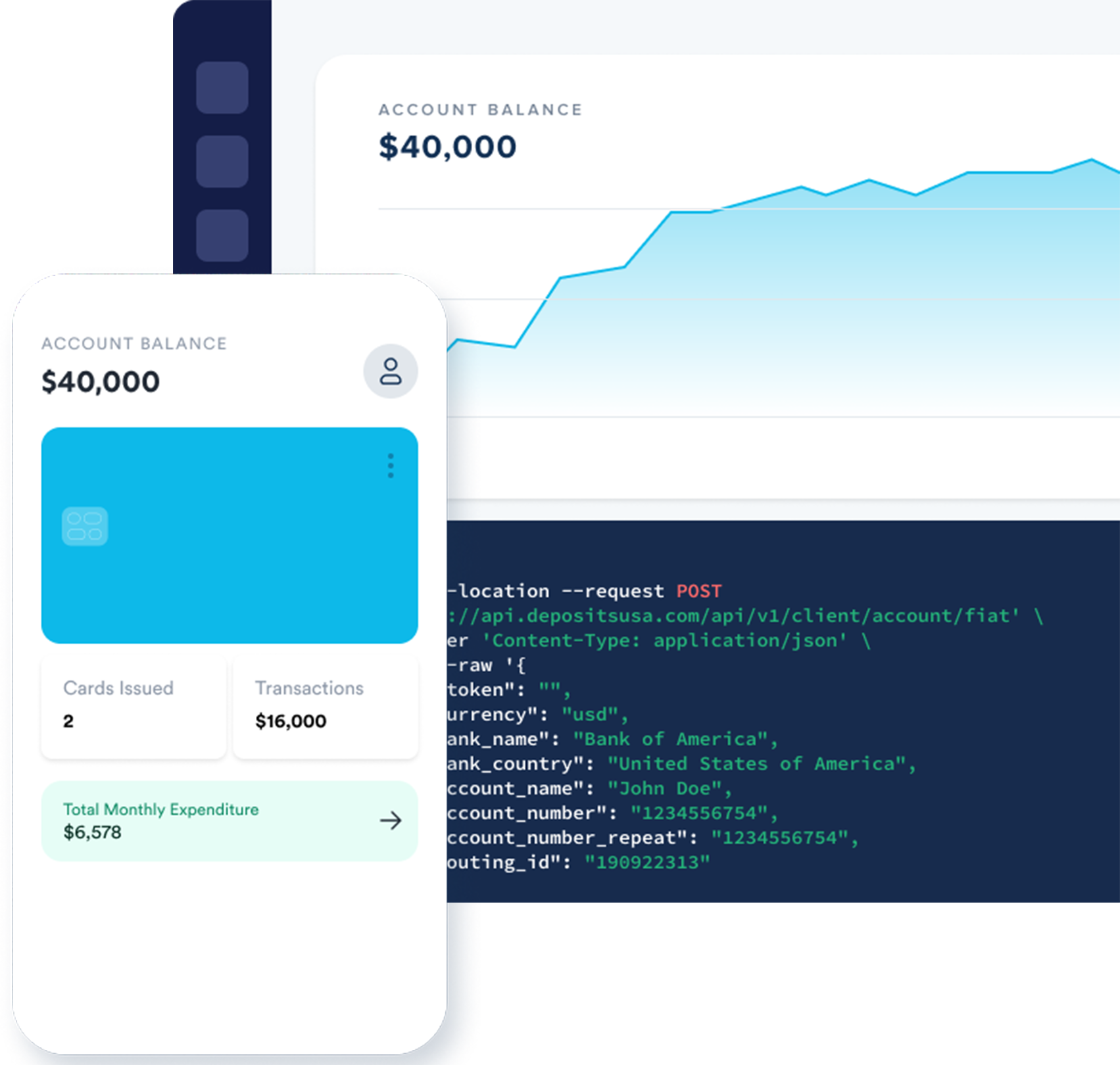

Deposit Accounts

Bank accounts and Bank transfer services for your Neobank or embedded banking use case

Debit and Credit Cards

Sell in-person, online, or from anywhere. Take secure payments from customers, clients, and more.

Increase your revenue

Sell in-person, online, or from anywhere. Take secure payments from customers, clients, and more.

HOW IT WORKS

Low-code banking-as-a-service

Everything you need to get started, grow, and increase revenue. Tailor our technology to your branding for a seamless user experience.

Start Building Documentation

use cases

What can you build with Banking Kit?

With our plug-and-play digital banking kits, you can quickly launch your highly secure and feature-rich banking services.

NeoBank

Provide banking services to your users, and manage accounts and transactions digitally.

Retail Fintech

Enable your users to create accounts online to make things easier for them.

Embedded Banking

Make digital wire and ACH transfers accessible to your customers.

Have something else in mind?

Get in touch, and we'll help you explore how you can build a custom financial product that's right for your customers.

Talk to salesOur team is standing by and ready to help. Get live support from our team by phone, chat, or email, or reference the Help Center anytime.

Contact usFrequently asked questions

Banking-as-a-service. Digital Banking platform designed for small businesses, with corporate spend card, control, and role-based access for teams. Turn-key and ready to deploy with your brand, your sponsor bank, or our partner banks

We partner with regulated and insured financial institutions to enable you to offer accounts. You can also bring your institution and plugin to the back office.

Yes, commercial and consumer debit cards are available through the platform for your users.

This use of banking is limited to businesses resident in the United States of America. But this doesn't limit FX transactions on the platform.

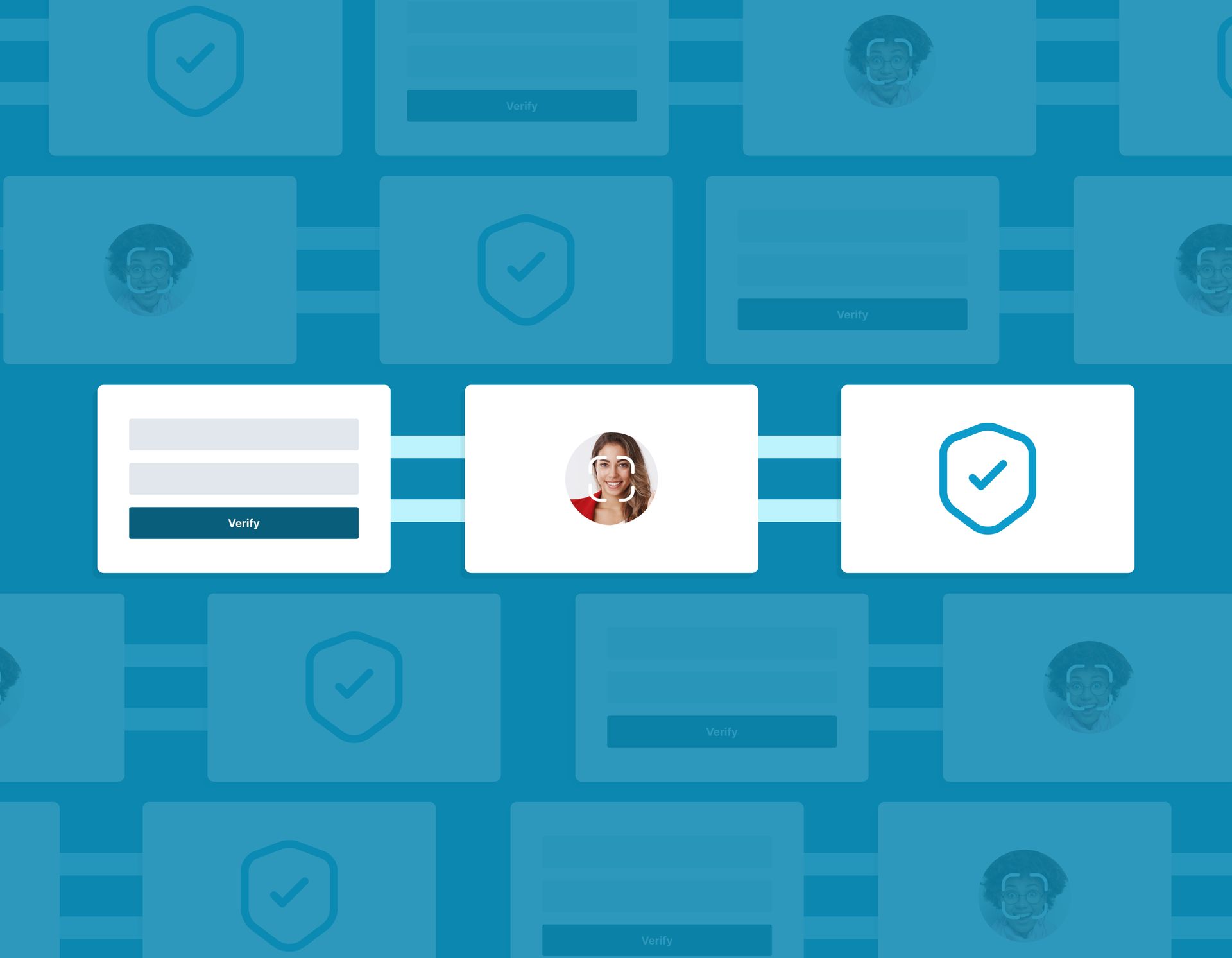

Your brand is responsible for KYB, and we recommend you make use of the Deposits Kysync service, which is a robust turn-key KYC/KYB API, SDK, and back-office

Open accounts, issue cards, and make money move

With our plug-and-play digital banking kits, you can quickly launch your highly secure and feature-rich banking services.

Commerce Kit

Add commerce anywhere, within your marketplace, app, or community portal. From B2B, B2C, D2C, for Influencers, content publishers, communities, or Financial institutions

See commerce kit

Money Kit

Build and launch international remittance, multi-currency wallets, PFM app, or bill pay. The money-kit from Deposits is the toolkit to launch innovative fintech products

See money kit

Banking Kit

Bank accounts, Virtual cards, ACH Transfers, Wire Transfers, Account Transfers, Invoices, Payment pages and everything to support small businesses online

See banking kitResources to keep you moving forward.

It’s your business. We just

want to help you keep doing it.

Can Community Banks Survive the Digital Age?

In the digital age, it is no surprise that people are preferring to use online banks over traditional community banks.

Read Now

Why and how community banks go digital

Community banks are described as those with $10 billion or less in assets. They provide banking services to local communities.

Read Now

KYC with Kysync

KYC is becoming more strict across companies, especially financial institutions and it is driving a lot of their business decisions.

Read NowGet real support.

Talk to our Sales team

Find out which products fit your business needs and get questions answered.

Contact salesSupport Center

Access helpful tips, articles, and videos to get the most out of Deposits.

Visit our Support Center